A couple of weeks ago I posed a situation that might be close to some of you-a case of financial infidelity. The premise of the story was that someone, without their spouse's knowledge, signed up for a credit card, and racked the debt up to 20,000 or $25,000 in debt. When the credit card company started calling because payments were late or incomplete it broke open and there was much hurt and distrust, and even thoughts of divorce.

How do we overcome financial infidelity?

First, we need to know the definition of financial infidelity. Wikipedia defines financial infidelity this way:

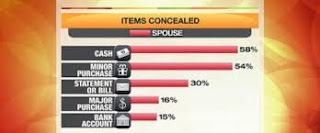

Financial infidelity is the secretive act of spending money, possessing credit and credit cards, holding secret accounts or stashes of money, borrowing money, or otherwise incurring debt unknown to one's spouse, partner, or significant other.[1] Adding to the monetary strain commonly associated with financial infidelity in a relationship is a subsequent loss of intimacy and trust in the relationship. Financial infidelity appears to be on the rise, with a 2005 study showing that 30% of respondents had lied about financial information and 25% had withheld information,[2] whereas a 2008 study showed that half the respondents had committed some form of financial infidelity.[3]

Come clean

The first step on the road to repair is to come clean with all your financial activities. Share all the activities as well as all the money that was spent on these activities. Write them down so you don't forget. This may hurt, especially if there are many incidents, but push through it and get it out on the table. Together, you may find that there are deeper issues like a gambling or spending problem and if you catch it now it could save you more heartache, and possibly your marriage, in the future. Make a commitment to never hide any important financial activity again.

Practice financial transparency

Practicing financial transparency is the first step to rebuilding trust.

- This means following a spending plan agreed upon by both of you. This means you both have a vote and you don't move forward unless you both agree.

- Freeing up a little bit of spending money so you both can have some money to call your own and are not required to share.

Once you've come clean and agreed to practice financial transparency you'll want to keep yourselves accountable. This is the purpose of money meetings.

Pick a time that works for both of you, not late at night when you're both tired, or when you're on the go and are focusing on many other things or when each of you are at work. Pick a time and even put it on the calendar if necessary so you don't forget.

Here are some of the topics you may discuss during this time:

- How is each of you doing overall? This is a general question that may take some time. Enough time spent here may be more important than the other items combined.

- Keep in mind your spouse's mindset on financial matters. I love spreadsheets and getting down to the nitty gritty of financial matters whereas my wife likes to look at money issues from the 10,000 foot level, without a lot of numbers.

- If available do you need to free up or cut some more money for a particular budget item? Groceries, Recreation, Transportation, Savings, etc. If you are living tightly you may not have this luxury, don't be tempted to increase the budget item if you don't have the money. Remember that each person has a vote in this process, resist the tendency to think your spouse is stupid for thinking the way he/she does. Also, as Dave Ramsey has said that, and I agree with, any spending outside the spending plan is financial infidelity.

The final step and one that should be present throughout the process is to be humble and apologetic. Realize you've made a mistake or several mistakes and work hard to make it right. This will allow you to rebuild trust in your marriage and work towards complete trust. This will also get you started on the path of financial healing. This may take a while but sticking with it will be worth it in the long run.

Listen to and/or read this case of Financial infidelity from Dave Ramsey

I want to promise as you follow these steps and come clean, practice financial transparency, have regular meetings, and are humble and apologetic you'll feel the walls come down, trust enter back into your marriage, feel love and peace return to your home and lives.

Thank you for taking the time to read this blog, let me know if you have any comments or experiences that you'd like to share.

Thanks,

Greg and Jody